Medical Anthem Hdhp Dmg High Co

- Anthem Blue Cross Hdhp Plan

- Medical Anthem Hdhp Dmg High College

- Anthem Hdhp Provider List

- Medical Anthem Hdhp Dmg High Co In Florida

The Anthem HDHP and Health Savings Account (HSA) combine comprehensive medical coverage and a tax-advantaged savings account. The HDHP provides access to high-quality health care through Anthem's provider network. The plan pays a large part of medical costs after the deductible is met and your expenses are limited by an out-of-pocket maximum.

Anthem Blue Cross Hdhp Plan

Premiums, Deductibles, Out-of-Pocket Costs, Oh My!

Picking the insurance plan that is right for you.

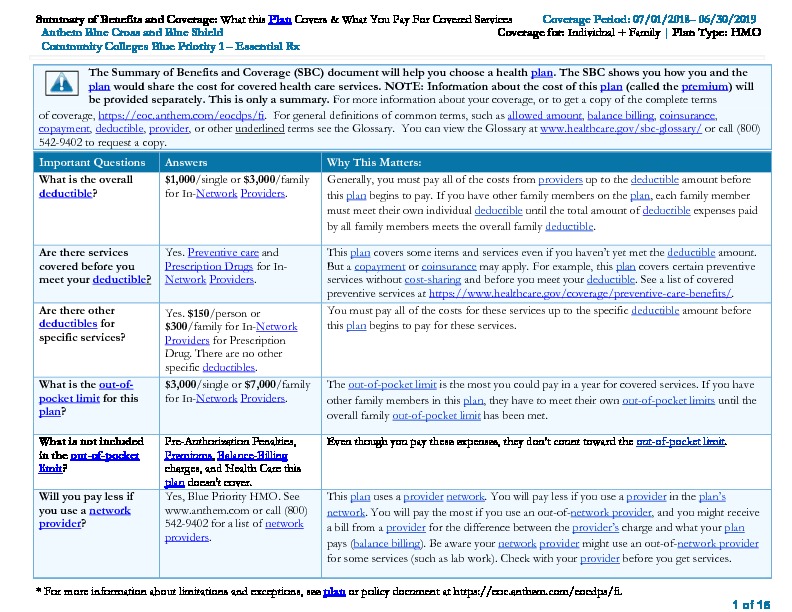

Selecting the right health insurance plan is an important decision and at times can feel like a daunting task. Coverage is continually changing and there are more confusing health insurance terms out there than ever before. DMG enables you to crack the health insurance code and provide simple steps to allow you to pick a plan based on the total costs of care.

What is the “total cost” of health insurance?

- Monthly Premium is what you pay to the insurance company for coverage (regardless of whether or not you received medical care that month)

- Annual deductible (varies by plan) is the amount you are responsible for paying for medical expenses before the insurance company pays for anything (except preventive services like a pap smear or routine physical, which you are entitled to each year free of charge). Some plans may also have separate deductibles for things like prescription drugs. Family plans usually specify both an individual deductible, that applies to each covered family member as well as a family deductible, which applies to all family members.

- Copayments or coinsurance (varies by plan) are payments you are responsible for each time you receive medical services, even after you have met the annual deductible. Copayments and coinsurance for in-network providers are often lower than out-of-network providers. Many insurance plans specify which network and providers are preferred and are considered in-network and all other providers are out of network. If you are unsure, your insurance carrier can help you determine what providers and networks are preferred either through lists on their website or by calling the customer service number listed on the back of the insurance card.

- Out-of-Pocket Maximum (varies by plan) is the most you will spend to receive covered services in a year. Once this amount is reached, the insurance company will pay the full amount for any additional, covered services provided by an in-network provider. (The out-of-pocket maximum does not include your premium or any money you spend on services not covered by your plan).

What are the most common types of health insurance plans?

HMO (Health Maintenance Organization)Dmg to iso windows.

This type of plan usually limits coverage to providers that are contracted with the HMO or are within the plan’s network. The plan usually does not cover out-of-network care except in the event of an emergency. These plans also require a referral from your primary care physician before seeing a specialist.

PPO (Preferred Provider Organization)

This type of plan may also encourage use of in network providers and may have a smaller deductible, copay or coinsurance if providers in the plan’s network are utilized. Doctors, hospitals, and providers outside of the network can be seen without a referral for an additional cost. This type of plan typically has the highest monthly premium but often has a lower annual deductible, lower copayments and the most flexibility in choosing providers.

HDHP (High Deductible Health Plan)

This plan usually has the lowest monthly premium, but the tradeoff is a higher deductible than a traditional HMO or PPO plan. With a higher deductible you pay more out-of- pocket initially before the insurance company will begin to cover costs. A high deductible health plan is classified as a plan with a deductible of at least $1,300 for an individual or $2,600 for a family. An HDHP’s total yearly out-of-pocket expenses (including deductibles, copayments, and coinsurance) can’t be more than $6,550 for an individual or $13,100 for a family. (This limit doesn’t apply to out-of-network services.)

Picking Your Plan:

Start by thinking about what medical services you will likely use in the upcoming year. You can try to estimate based on previous health needs or patterns. For example, if have a chronic condition that requires you to visit a specialist every three months, you can safely estimate four specialty care visits. You may also want to factor in 1-2 sick visits per year if you are prone to colds or other seasonal illness. While it is next to impossible to be able to predict exactly what health care you will need, estimating your needs is helpful to determine what each plan’s actual cost may be.

In general, plans with higher premiums pay more up-front costs. Plans with lower premiums (most often a HDHP) will initially cover less of your health care costs. If you don’t anticipate regular trips to the doctor and are not on routine medications, a lower premium plan may work for you. These plans will save you money each month with a lower premium, as long as you are prepared to have a higher annual deductible, which you will have to meet before insurance starts to cover costs when you do need care.

Medical Anthem Hdhp Dmg High College

If you tend to be a frequent visitor at your physician’s office or need regular prescriptions, you may want to opt for the higher premium plans (PPO or HMO plans). These plans cost more per month but will cover more of your health care expenses when you receive care.

Full Specifications What's new in version 3.0.2. Japanese localization.GeneralPublisherPublisher web siteRelease DateJune 21, 2004Date AddedJune 21, 2004Version3.0.2CategoryCategorySubcategoryOperating SystemsOperating SystemsMac OS X 10.2/10.3Additional Requirements. Mac OS X 10.2 or higherDownload InformationFile Size116.02KBFile Namedmgtool3.dmg.gzPopularityTotal Downloads728Downloads Last Week1PricingLicense ModelFreeLimitationsNot availablePriceFree. No more drag and drop crashing. 3utools for mac dmg download.

Here are some common, real-life examples to help show how these additional costs can affect your overall healthcare cost.

Your Coverage Details:

Deductible: $2,000

Coinsurance: 20%

Out-of-pocket maximum: $6,000

- Example 1: After coming down with a flu virus, you see your primary care provider and the visit costs $100. One of two things will happen:

- If you have met your deductible you will be responsible for 20% of the $100 visit ($20) and the insurance will pay for the remaining $80.

- If you haven’t met your deductible, you will be responsible for the full amount of $100 until your deductible has been met.

- Example 2: You are hospitalized after a car accident and between admission, testing and physician charges, have a $10,000 claim. Here is what would happen in this scenario (assuming you have not been to the doctor yet during the year):

- First you would pay all of the first $2,000 to meet your deductible.

- Next, you would be responsible for 20% of the remaining $8,000 ($1,600) which is your coinsurance amount.

In this example, your total out-of-pocket costs would be $3,600. Had the charges exceeded your total out-of-pocket maximum, you would only be charged up to that maximum amount and your insurance would pay the remaining charges for all covered services for the rest of your plan year.

In order to minimize the impact medical expenses have on your household, you can also put money aside in pre-tax medical expense savings accounts. These accounts may only be used to pay for approved medical expenses. There are two types of accounts that work similarly but do have some key differences.

Pre-Taxed Medical Savings Accounts:

Flexible Spending Account (FSA)

A FSA account is a health expenses savings account set up through your employer to use towards out- of pocket medical expenses. A pre-set amount is deducted from each paycheck and saved in the account. Eligible health care expenses often include a co-pay, deductible payments and certain prescriptions and medical equipment.

Money in an FSA account cannot be rolled over to be used the next year, so it is important to only save what you think you will actually need and use each year to avoid losing any un-used funds. Your employer will also set a limit on the amount each individual can put into an FSA each year.

Health Savings Account - HSA

This type of savings account also allows you save money to use towards approved medical expenses. Unlike an FSA account, an HSA can only be used in conjunction with a HDHP (all other plans can utilize a FSA account). HSA accounts are used by HDHP participants pay to for medical expenses while working towards the annual deductible to help cover medical costs as they occur, ranging from office visits, prescriptions, lab work and other types of diagnostic testing. Using these pre-taxed funds helps to reduce the overall cost of the plan for the patient. Unlike FSA accounts, unused HSA funds can be rolled over year over year and can even earn interest.

Understanding the different plans available is an important step towards managing the impact health care has on your wallet. Selecting a plan that best fits your needs by estimating the total anticipated cost of care and utilizing medical savings accounts to help pay for out-of- pocket medical expenses can help reduce the likelihood of being caught off guard by a large claim.

As always, it is important to remember, the plan you chose does NOT impact the quality of care you will receive at DMG. If you have additional questions specific to your policy, please contact your insurance carrier.

Anthem Hdhp Provider List

- Carelink

- Choice

- EPO

- Elect Choice

- HMO

- Managed Choice

- Open Access

- Open Choice

- PPO

- QPOS

- Select

- Signature

- State of Illinois

- Blue Advantage HMO

- Blue Choice Options

- Blue Choice Preferred PPO (Bronze/Silver/Gold)

- Blue Choice Select PPO

- Blue Choice Select Value

- Blue Cross Community Health Plans

- Blue Cross Community MMAI

(Dual Eligibles) - Blue Edge/Blue Edge Select EPO

- Blue Edge/Blue Edge Select PPO

- Blue Options EPO

- Blue Options PPO

- Blue Precision HMO

- Blue Precision HMO (Bronze/Silver/Gold)

DMG does not participate in Blue Care Direct - Blue Print EPO

- Blue Print PPO

- Blue Security EPO

- Blue Security PPO

- Federal Employee

- HMO Illinois

- Labor Fund

- Medicare Advantage Basic (HMO)

- Medicare Advantage Basic Plus (HMO-POS)

- Medicare Advantage Choice Plus PPO

- Medicare Advantage Choice Premier PPO

- Medicare Advantage Elite (HMO-POS)

- Medicare Advantage Premier Plus (HMO-POS)

- Multi-State EPO

- Multi-State PPO

- State of Illinois

- Value Choice EPO

- Value Choice PPO

- C-5

- Choice

- EPO

- Network

- Open Access

- POS

- PPO

(note: we do not participate in LocalPlus)

- Advantage (Medicare Advantage HMO)

- Preferred (Medicare Advantage HMO)

- Premier (Medicare Advantage HMO-POS)

- True Choice (Medicare Advantage PPO)

- PPO

- Advantage HMO

- Advantage PPO

- EPO

- PPO

- EPO

- PPO

- Open Access

- POS

- PPO

- EPO

- PPO

- HMO

- ChoiceCare

- EPO

- HMO

- MMAI (Medicare-Medicaid Alignment Initiative)

- Medicare Advantage Choice PPO

- Medicare Advantage Choice Regional PPO

- Medicare Advantage Gold Choice PFFS

- Medicare Advantage Gold Plus HMO

- Medicare Advantage Gold Plus HMO/POS

- Medicare Advantage SNP

(Special Needs Plan) - National

- POS

- PPO

- Premier

- Imagine Health

- Medicare

- PPO

- Preferred Network Access (PNA)

- PPO

- PPO

- American Medical Security

- Choice POS

- Choice Plus POS

- Core POS

- Definity Health

- Fiserv

- Golden Rule

- Medicare Advantage AARP Medicare Complete

(note: we do not participate in the Complete Access network)

- Medicare Advantage HMO

- Medicare Advantage HMO-POS

- Medicare Advantage PPO

- Midwest Security Administrators

- Navigate HMO

- Navigate POS

- Options PPO

- Premier HMO

- Select HMO

- Select POS

- Select Plus HMO

- Select Plus POS

- United Medical Resources

Medical Anthem Hdhp Dmg High Co In Florida

- Blue Cross Blue Shield Blue Choice Preferred PPO (Bronze/Silver/Gold)

- Blue Cross Blue Shield Blue Precision HMO (Bronze/Silver/Gold)

DMG does not participate in Blue Care Direct

- Aetna Select

- Aetna QPOS

- Aetna EPO

- Aetna Elect Choice

- Aetna Choice

- Aetna Carelink

- Aetna Signature

- Aetna HMO

- Aetna State of Illinois

- Aetna Managed Choice

- Aetna Open Access

- Aetna Open Choice

- Aetna PPO

- Blue Cross Blue Shield Labor Fund

- Blue Cross Blue Shield State of Illinois

- Blue Cross Blue Shield Blue Advantage HMO

- Blue Cross Blue Shield Multi-State EPO

- Blue Cross Blue Shield Federal Employee

- Blue Cross Blue Shield Multi-State PPO

- Blue Cross Blue Shield HMO Illinois

- Blue Cross Blue Shield Value Choice PPO

- Blue Cross Blue Shield Blue Choice Select Value

- Blue Cross Blue Shield Blue Choice Select PPO

- Blue Cross Blue Shield Blue Edge/Blue Edge Select EPO

- Blue Cross Blue Shield Blue Edge/Blue Edge Select PPO

- Blue Cross Blue Shield Blue Options EPO

- Blue Cross Blue Shield Blue Options PPO

- Blue Cross Blue Shield Blue Precision HMO

- Blue Cross Blue Shield Blue Print EPO

- Blue Cross Blue Shield Blue Security EPO

- Blue Cross Blue Shield Blue Print PPO

- Blue Cross Blue Shield Blue Security PPO

- Blue Cross Blue Shield Blue Choice Options

- Blue Cross Blue Shield Value Choice EPO

- Cigna Choice

- Cigna Open Access

- Cigna Network

- Cigna PPO

(note: we do not participate in LocalPlus)

- Cigna POS

- Cigna C-5

- Cigna EPO

- CoreCare/CorVel PPO

- Coventry Healthcare PPO

- Coventry Healthcare EPO

- First Health EPO

- First Health PPO

- Great West Healthcare Open Access

- Great West Healthcare POS

- Great West Healthcare PPO

- Healthlink HMO

- HFN PPO

- HFN EPO

- Humana PPO

- Humana Premier

- Humana ChoiceCare

- Humana POS

- Humana National

- Humana HMO

- Humana EPO

- Imagine Health Imagine Health

- MultiPlan PPO

- Preferred Network Access (PNA) Preferred Network Access (PNA)

- Preferred Plan PPO PPO

- Private Healthcare Systems (PHCS) PPO

- United Healthcare Select HMO

- United Healthcare United Medical Resources

- United Healthcare Select Plus HMO

- United Healthcare Select Plus POS

- United Healthcare Select POS

- United Healthcare American Medical Security

- United Healthcare Premier HMO

- United Healthcare Options PPO

- United Healthcare Navigate POS

- United Healthcare Navigate HMO

- United Healthcare Golden Rule

- United Healthcare Fiserv

- United Healthcare Definity Health

- United Healthcare Core POS

- United Healthcare Choice Plus POS

- United Healthcare Choice POS

- United Healthcare Midwest Security Administrators

- Blue Cross Blue Shield Blue Cross Community Health Plans

- Blue Cross Blue Shield Blue Cross Community MMAI

(Dual Eligibles) - Humana MMAI (Medicare-Medicaid Alignment Initiative)

- Medicare Medicare

- Blue Cross Blue Shield Medicare Advantage Elite (HMO-POS)

- Blue Cross Blue Shield Medicare Advantage Basic (HMO)

- Blue Cross Blue Shield Medicare Advantage Basic Plus (HMO-POS)

- Blue Cross Blue Shield Medicare Advantage Premier Plus (HMO-POS)

- Blue Cross Blue Shield Medicare Advantage Choice Plus PPO

- Blue Cross Blue Shield Medicare Advantage Choice Premier PPO

- Cigna-HealthSpring Advantage (Medicare Advantage HMO)

- Cigna-HealthSpring Premier (Medicare Advantage HMO-POS)

- Cigna-HealthSpring Preferred (Medicare Advantage HMO)

- Cigna-HealthSpring True Choice (Medicare Advantage PPO)

- Coventry Healthcare Advantage PPO

- Coventry Healthcare Advantage HMO

- Humana Medicare Advantage Choice Regional PPO

- Humana Medicare Advantage Gold Plus HMO

- Humana Medicare Advantage Gold Plus HMO/POS

- Humana Medicare Advantage Choice PPO

- Humana Medicare Advantage SNP

(Special Needs Plan) - Humana Medicare Advantage Gold Choice PFFS

- United Healthcare Medicare Advantage HMO

- United Healthcare Medicare Advantage HMO-POS

- United Healthcare Medicare Advantage PPO

- United Healthcare Medicare Advantage AARP Medicare Complete

(note: we do not participate in the Complete Access network)